Pay Payment Processing for Restaurants Built to Drive Revenue

Protect and maximize your digital business with a unified, restaurant-specific payments platform

2024 Olo online payments data

Olo Pay

Easily manage payments at scale using the same platform as your digital ecosystem.

Olo Pay works on your behalf to drive direct digital sales, prevent fraud, and streamline day-to-day payment processes.

-

Online and in-store payment processing

-

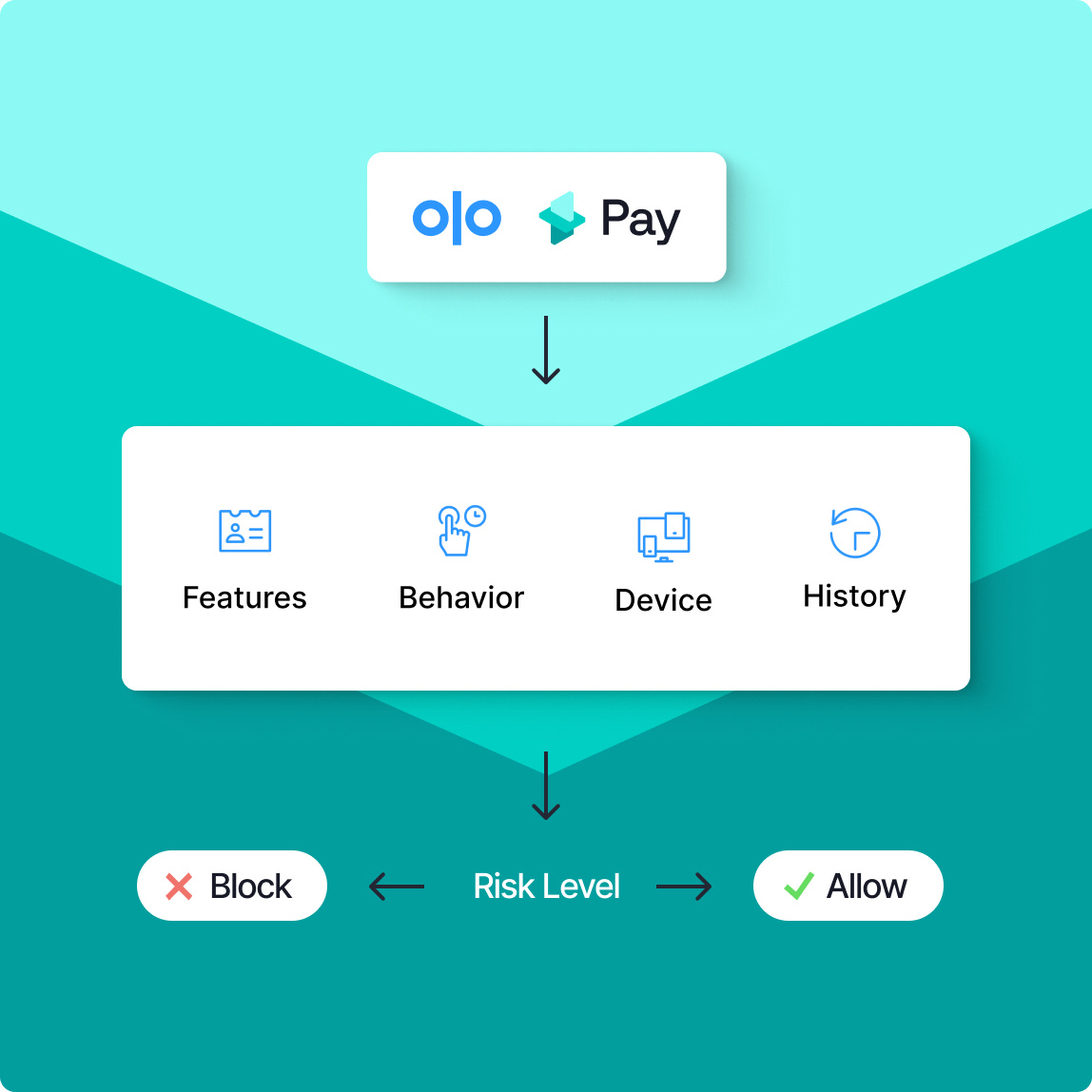

Integrated fraud prevention

-

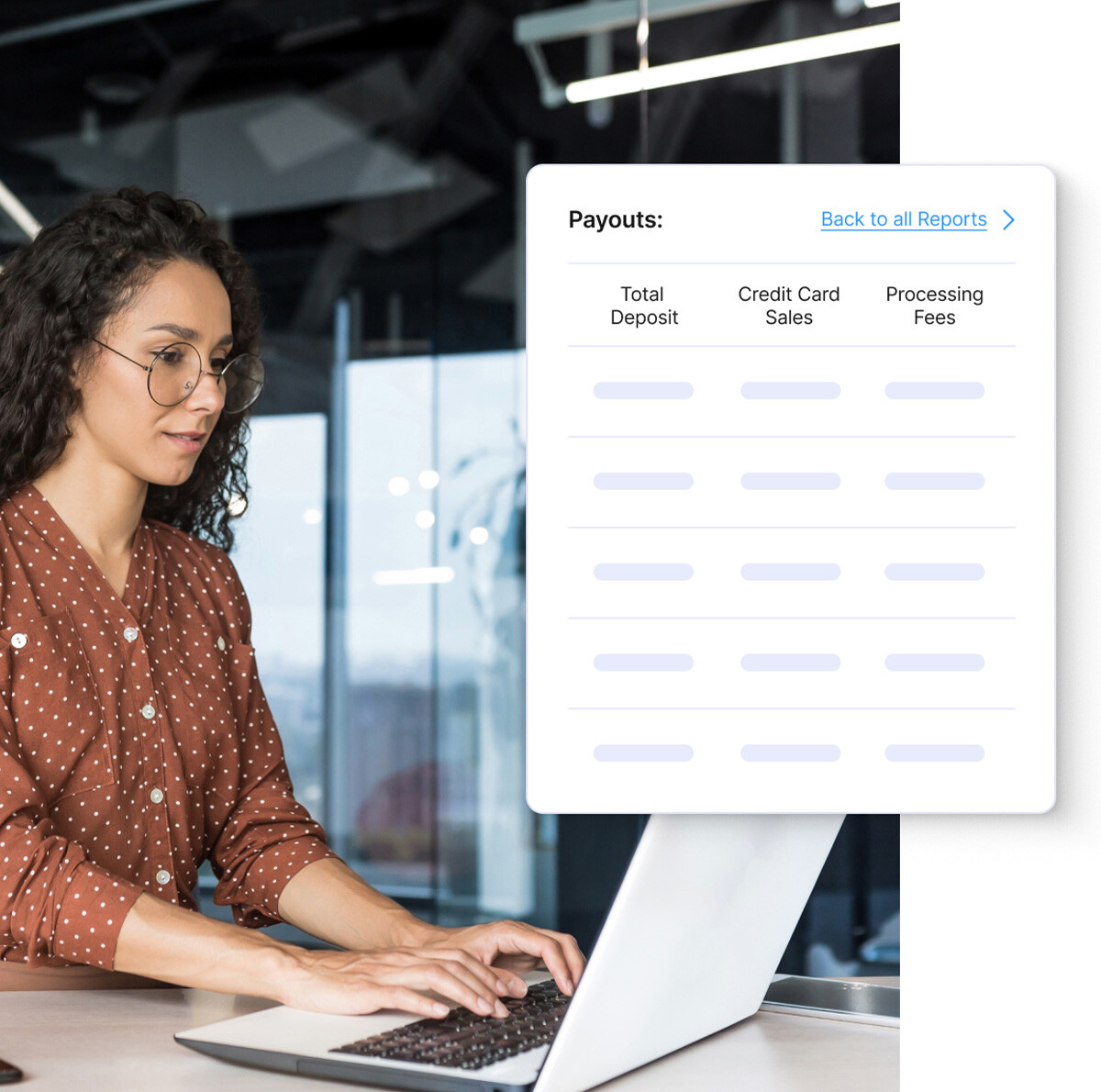

Unified reporting

-

Passwordless and digital wallet checkout

How a restaurant-specific payment platform could accelerate your revenue growth

Olo Pay Impact Calculator

See how much additional revenue your brand could generate from online orders with the fraud prevention and increased authorization rates of Olo Pay.

Indicate your brand's annual online order volume:

Calculation disclaimer

The calculations in this table are based on a 5% lift in authorization rate and a 30% reduction in fraud, assuming a 0.75% dispute rate. These are averages Olo often sees with brands using legacy payment processors. Olo does not guarantee the same results for your restaurant, as these assumptions may not always be true.

Expected annual revenue lift with Olo Pay

Want to find out how Olo Pay stacks up against your processor?

Talk to an Olo ExpertPay Features

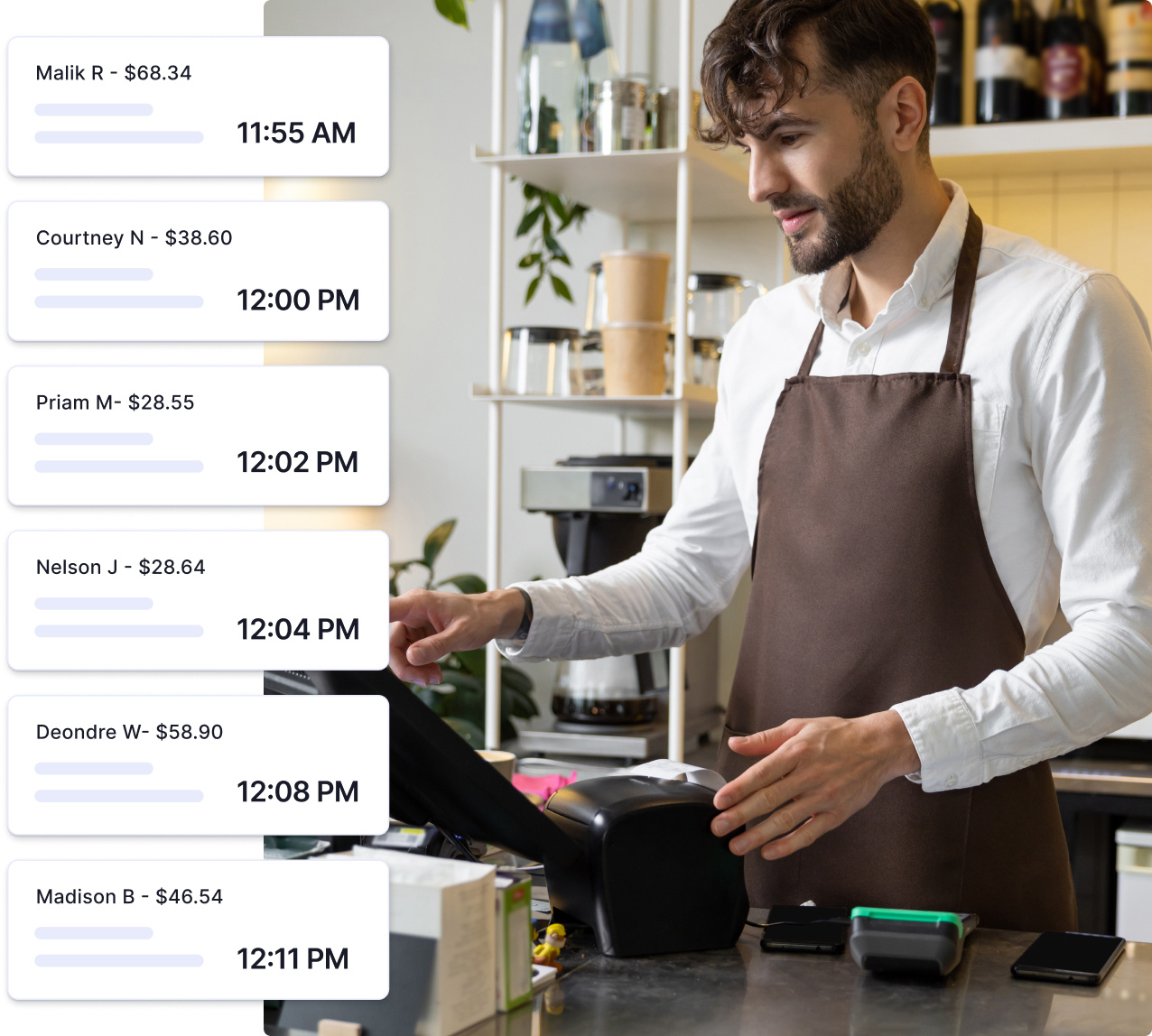

Save time by consolidating your online and in-store payments in a single platform

Manage and reconcile 100% of digital transactions—card-present and card-not-present—in one place.

With in-store and digital transactions aggregated in the Olo Dashboard, your teams can enjoy simplified payments management—spending less time navigating multiple platforms to reconcile, refund, and void—and more time focusing on guests.

Protect your business from fraud

Ensure payments are processed securely and stay ahead of sophisticated fraud attacks with Olo Pay’s advanced security features—including integrated machine-learning fraud detection and prevention, compliance with industry regulations, and secure data management.

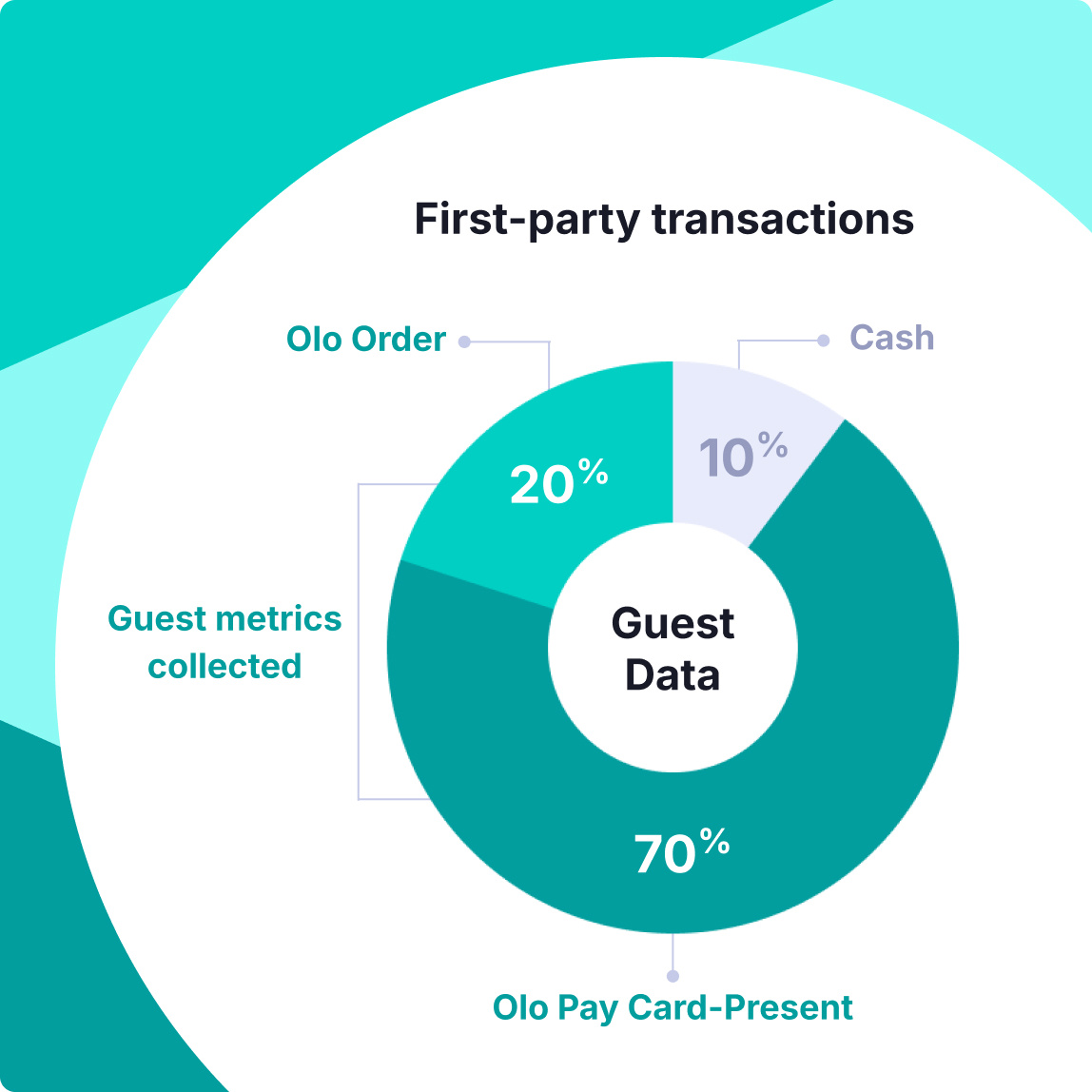

More guest data, leading to better understanding

By using Olo Pay Card-Present, you can gain insight into previously unreachable in-store transactions.

With more data about guest interactions, you get a much more accurate and comprehensive picture of who your guests are and how they interact with your business—which leads to more informed strategies on ways to drive profitable traffic.

Maximize revenue with an elevated guest experience

Meet the expectations of today’s digital-first guests by offering seamless checkout, digital wallet support, and industry-high authorization rates.

- Apple Pay and Google Pay support

- In-store self-service kiosks

- Passwordless guest login and checkout with Olo Accounts

- Simplified ordering interface

Improve restaurant operations

Grow digital orders with confidence, offering your guests a seamless payment experience built to scale along with your brand. Olo Pay offers support for high-volume transactions, flexible payment schedules, and integrations with all major POS platforms.

- Support of multiple payment methods—including credit cards, contactless payments, and mobile wallets

- Modern, EMV-compatible payment terminals that are easy to set up

- Point-to-point encryption for the highest level of data protection

- Offline capabilities

- Quick and painless onboarding

- Increased visibility and controls

Optimize your payments. Boost your bottom line.

Customers who use Pay

Online credit card fraud was by and large the biggest pain point we had that we didn't have an answer to. With Olo Pay, we no longer have to manage our fraud prevention in-house. It save us labor hours and we can take more revenue to the bank.

We knew we needed a restaurant-specific platform to process digital payments and combat fraud all in one place. Olo Pay is fully integrated with our tech stack, easy to set up, and we finally have a strong relationship with our payment provider.

We want to be in the stir-fry and salad business, not the payment processing business. We’re saving a great deal on chargeback costs, plus we increased efficiency, guest satisfaction, and our authorization rate.

Restaurant growth starts here

Simplify payment processes with Olo Pay.